Strategic due diligence

VEP helps clients in private equity and structured finance manage the strategic risks and opportunities of their proposed investments.

This is strategic due diligence, also known as commercial due diligence or market due diligence.

We typically assess risks and opportunities under the following categories:

1. Market demand trends - by key segment, drivers, forecasts, risks and opportunities

2. Industry competitive intensity - forces, change, risks and opportunities

3. Company strategy - evolving competitive position by segment, strategy, plans, risks and opportunities

4. Management’s revenue and operating profit forecasts, viewed against trends in market demand, competitive intensity and future competitive position

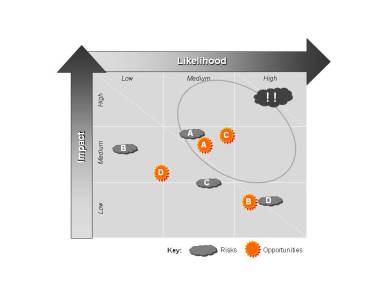

5. Summary of strategic risks and opportunities to the investor, ranked by impact on value and likelihood of occurrence - see the Suns & Clouds chart below, developed by Vaughan Evans in

the early 1990s

We advise on how to manage these risks and opportunities - how to mitigate the risks and exploit the opportunities.

VEP understands the questions investors need answering prior to the decision by the Investment Committee. Likewise, questions from a very different perspective that lenders need to address prior to presenting to their Credit Committee.

We address these head on. And provide ammunition for clients to negotiate deal price and structure. Or to

walk away.

VEP helps get good deals done.

Contact us to find out more.